The development trajectory of carbon projects

In this blog post, Kita co-founder and CPO, Tom Merriman, considers a recent report from Abatable. The report suggests that there is more funding going towards carbon projects than previously estimated. What does this mean for early stage carbon project development? And how can these projects navigate the challenges and risks they face?

The year is just over one month old and already there have been a slew of carbon related headlines. However, one of the most insightful reports I’ve read - published by Abatable - didn’t attract as much attention as it should have done.

While the recent news stories about the carbon market have either highlighted its somewhat lacklusture growth in 2023 (perhaps as companies worldwide feel the effects of tighter monetary policy), or the difficulties of measuring avoided carbon emissions from nature-based projects, there has been little coverage of all the activity among carbon project developers.

According to analysis from Abatable, funding involving carbon investors and project developers increased from $7bn to $10bn from 2021 to 2022. That’s a 40% increase. But these were only the disclosed deals. Abatable estimates that undisclosed deals may have more than doubled from $12bn in 2021 to as much as $26bn in 2022. For context, the size of the voluntary carbon market in 2022 is thought to be around $1.3bn, up from $1bn in 2021.

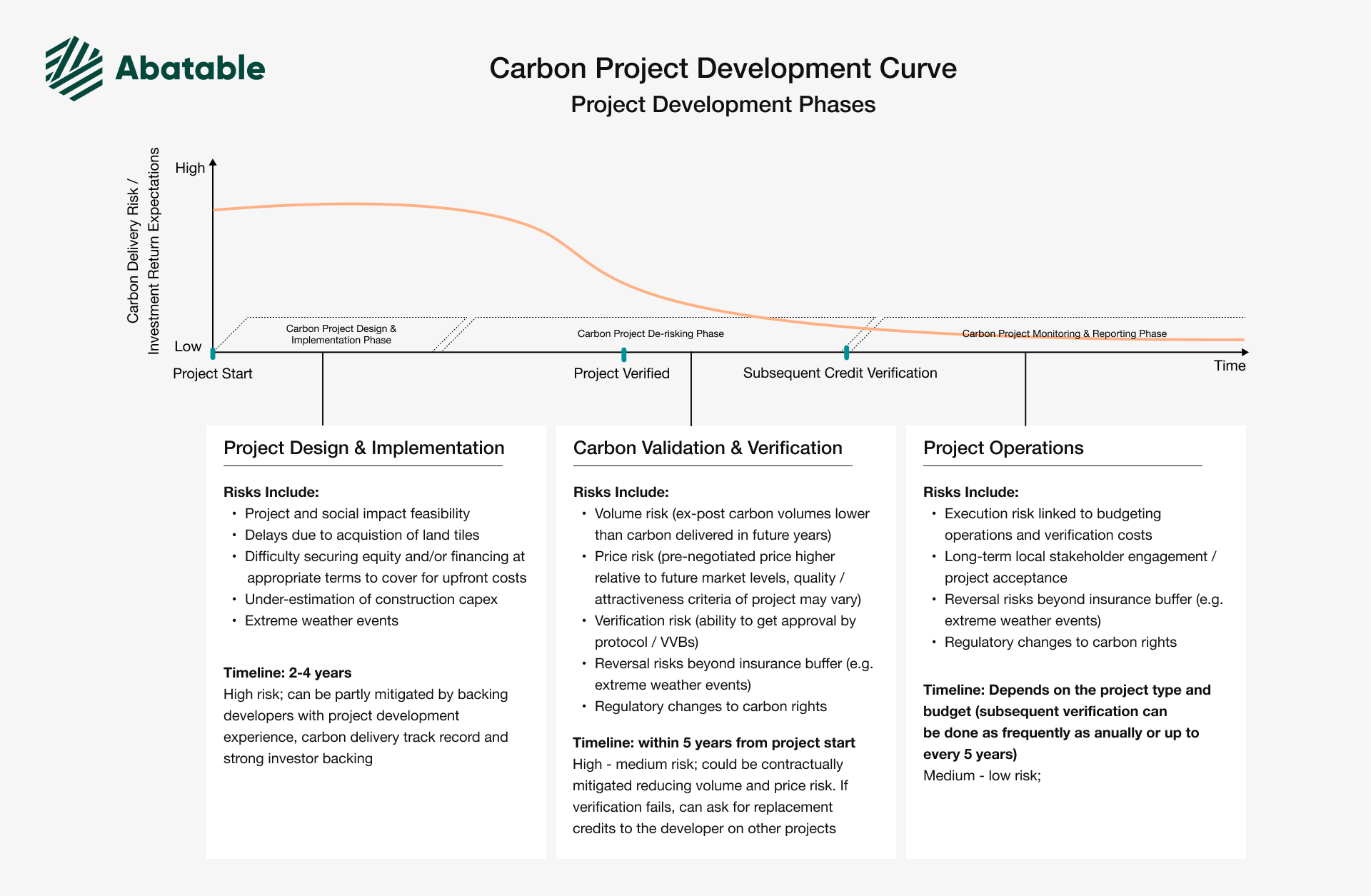

Further, Abatable claims that the financing is starting to trickle down to the earlier stages of carbon project development. The chart below shows the development stages of a typical carbon project. I’ve used similar charts when explaining how risk evolves over the life of a carbon project. The chart helps to explain the presence of ex-ante carbon credits - a financing structure that is not often found in other, similar commodities markets.

Carbon Project Development Lifecycle Schematic - Abatable

Abatable’s work suggests that a maturing carbon market will begin to resemble other, more established commodities markets, where early stage projects secure off-take agreements, find financing for the initial capital expenditure, and then use insurance to protect the revenue streams from the off-take agreements.

Several of the existing features within the carbon markets have emerged as stakeholders attempt to protect themselves against various risks (e.g. buffers), or facilitate the growth of the market in the absence of financing/risk transfer (ex-ante credits). Increased standardisation, as elsewhere in the carbon markets, will improve efficiency and transparency - helping to work towards the maturing carbon market highlighted by the report. Insurance plays a crucial role here.

While this emerging market may be yet to find the optimal financing mechanism (offsets have their pros and cons), investment is clearly required. A common barrier to this investment is the lack of an efficient risk transfer mechanism - the industry often relies on self-insurance, as alluded to above. Kita was founded to provide insurance to the carbon dioxide removal market in order to help it scale. By using the risk transfer mechanism that insurance provides, capital can be used more efficiently, risk shared more sustainably, and investors with lower risk appetites can participate in the market.

We recently launched our first product alongside Chaucer Group, Munich Re, and RenaissanceRe to help protect carbon buyers from delivery risk. This product will help to address the upfront financing risk highlighted in this report. It is the first of many specialist carbon insurance products that will help the industry grow at the pace we all need it to.