Kita launches full-spectrum Active Risk Monitoring services

The carbon insurance specialist now offers active risk monitoring services across all stages of the carbon lifecycle, providing project developers, buyers and investors with additional upfront due diligence, plus proactivity in ongoing risk management.

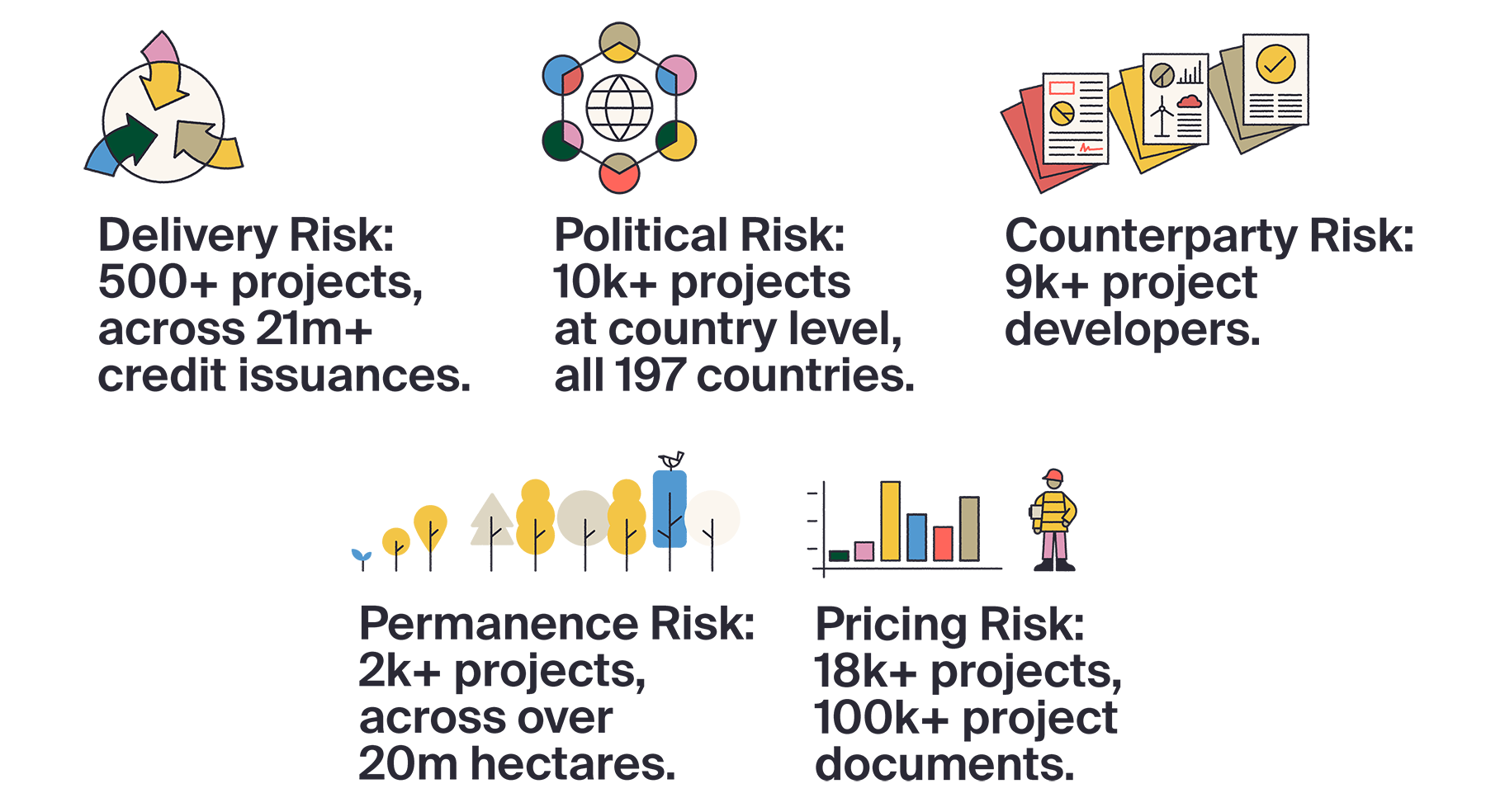

Drawing from Kita’s insurance risk model, which has assessed thousands of projects across the market, Kita's Active Risk Monitoring services provide objective, cost-effective assessments across commercial, technical and political categories, helping clients identify and understand insurable risks and assess projects on a comparative scale.

This comprehensive offering provides unbiased, thorough third-party risk assessment from a uniquely comparative perspective, with a focus on enabling early-stage project investment.

Kita, the carbon insurance specialist and Lloyd’s of London coverholder, is proud to announce today its Active Risk Monitoring services for the carbon markets. Kita has been providing these services since March 2024 to select stakeholders and is now broadening its reach to a wider span of the market.

Kita models risk in ex-ante projects daily as part of its insurance underwriting, which focuses on enabling investment into early-stage projects. Via this process, the business has collated a proprietary risk model, built on robust data and industry insights covering a wide variety of projects across the market. This data model is used in Kita’s Active Risk Monitoring services to assess projects on a comparative basis, and our near real-time monitoring ensures that the risk model is continuously adjusted to provide the most accurate and up-to-date analysis possible.

Kita’s Active Risk Monitoring services aim to support informed decision-making in investment processes. Our range of services include:

Risk Assessments: objective, cost-effective assessment of project risk and insurability across key categories, including commercial, technical and political risks, considering thousands of data points, including market benchmarks and specific project properties. Risk Assessments can be used by buyers/investors at the due diligence stage, to determine which project to invest in, or by project developers to demonstrate strong risk management to potential investors.

Portfolio Assessments: for companies holding an existing portfolio of carbon credits, Kita provides ongoing risk assessment and reporting on probabilities of loss and potential levels of shortfall at the portfolio-level, as well as sub-risk and carbon type categories.

Ongoing Health Checks: for carbon projects that Kita has insured, clients receive regular ‘health checks’ as a value-add, enabling confidence in ongoing performance, or quick identification should any problems arise that need to be addressed. This demonstrates how insurance companies can provide cost-effective risk management that supports high-performing projects.

As insurance becomes more commonplace across the carbon markets, the importance of understanding insurable/uninsurable risks on a project-level, as well as maintaining strong risk management across project lifecycles, is increasingly important. Kita is proud to announce this new range of services to the market.

“One of the key benefits of insurance in any market is its ability to not just protect against things going wrong, but to use underwriting data to provide proactive risk management to help things go right. Kita is delighted to bring this cost-effective risk management to the carbon markets in the form of our Active Risk Monitoring services. By offering an additional insurability lens on due diligence and quality assessment, plus proactivity in ongoing risk management to mitigate risks before they occur, the provision of Kita’s Active Risk Monitoring services can help channel significant global capital towards high-quality carbon projects.”

Natalia Dorfman, CEO and Co-Founder, Kita

“In carbon projects, the standalone nature of a project’s quality isn’t enough. It is important to understand how that project compares against its peers. Using market benchmarks and our comprehensive proprietary data sets gleaned from our long-standing insurance work with ex-ante projects, we can do just this and we look forward to bringing these services to a wider range of market participants.”

Paul Young, CTO and Co-Founder, Kita

Kita’s Active Risk Monitoring services provide informed insights to support risk management in carbon markets and assist with decision-making, however they do not constitute financial or investment advice. These services rely on current data and methodologies, which may evolve over time, and results are provided as estimates rather than guarantees of specific project outcomes or risk levels. Clients are advised to conduct their own due diligence and seek further independent advice where necessary.